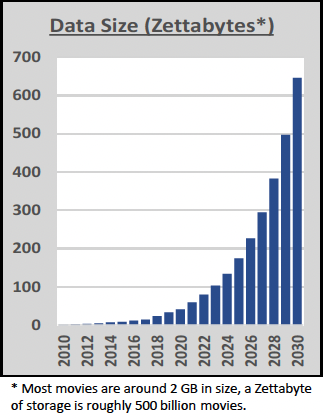

The amount of unstructured data is projected to inevitably explode on a monumental scale over the coming years.

Unstructured data refers to information that does not have a predefined data model or organization, making it more challenging to analyze and process using traditional methods. Examples of unstructured data in the financial industry include text documents, emails, press releases, news, fillings, social media posts, images, videos, and audio recordings.

Unstructured data refers to information that does not have a predefined data model or organization, making it more challenging to analyze and process using traditional methods. Examples of unstructured data in the financial industry include text documents, emails, press releases, news, fillings, social media posts, images, videos, and audio recordings.

Organizations struggle to corral and analyze unstructured data. Since most of the world’s data is unstructured, an ability to analyze and act on it presents a big opportunity. Whilst unstructured data is more challenging to interpret, effective analysis and processes deliver a more comprehensive and holistic understanding of the bigger picture.

Financial institutions are increasingly resourcing how to harness unstructured data to enhance how they analyze market conditions, make trading decisions, assess risks, target customers and improve customer service.

Pursuing digital alpha to provide professionals with premier opportunity and risk discovery insights is now front of mind.

Financial institutions are faced with a relentless growth of the quantity and variety of data, presenting huge challenges to effectively source, manage and distribute data and analysis. Issues managing data are often due to legacy systems, storage infrastructures that cannot handle unstructured data efficiently or data silos within businesses hindering salability.

Cloud-Based Data Management will continue to be adopted for scalability, cost-effectiveness and accessibility offered by the cloud. Increased adoption of data lakes; their scalability and efficiency will provide the basis for advanced data analytics, machine learning and artificial intelligence.

Firms will adopt a hybrid approach to implementations by licensing AI offerings and developing in-house capabilities. Data Science will continue to advance rapidly due to the proliferation of new data query languages and packages and the convergence of languages and other coding packages available to data scientists.

More ML and AI capabilities will be required to keep up with ever increasing data volumes and the demand for shorter turnarounds. As the data within firms expands, they will need to enhance their data governance programs to ensure that data is adequately managed, governed and protected.

Financial Institutions’ fiduciary and regulatory duties require them to now “own” their risk and ESG analysis.

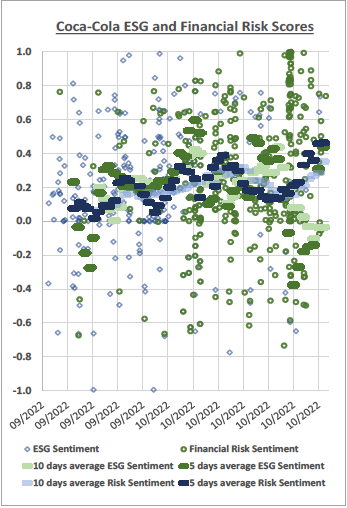

Given the plethora of unstructured data available on companies over long periods and on a daily basis, it’s possible to mine industry publications, regulatory filings, news, press releases and government studies to drive analysis and scores for risk and ESG factors for a broad array of U.S. and global companies.

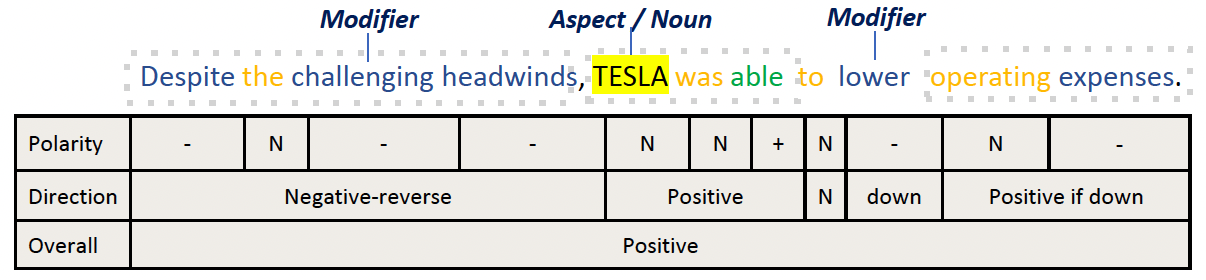

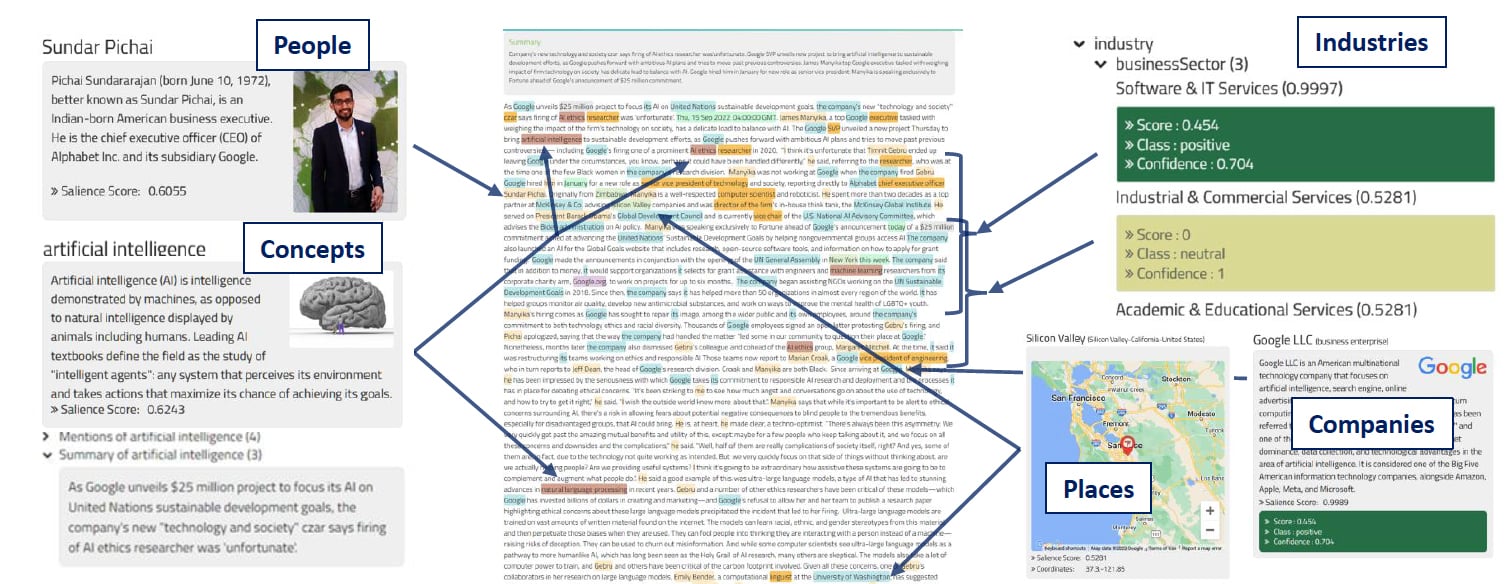

NLP algorithms have the ability to read articles, categorize items and extract positive and negative sentiments to produce an array of potential predictive indicators. Institutions can utilize such algorithms to dig into a broad range of categories of underlying data to see how they are exposed to specific risk and ESG factors. These Big-Data-driven signals can deploy self-learning quantitative models and data from unbiased sources with more frequency, granularity and real-time analysis than ones based on traditionally sourced data.

The common consensus is that transparency and ESG integration will become more profound, the ability to operate with reliable data will play a key role in that process. Not only can AI help extract relevant information from existing data sources, it also offers exciting opportunities to create new ones.

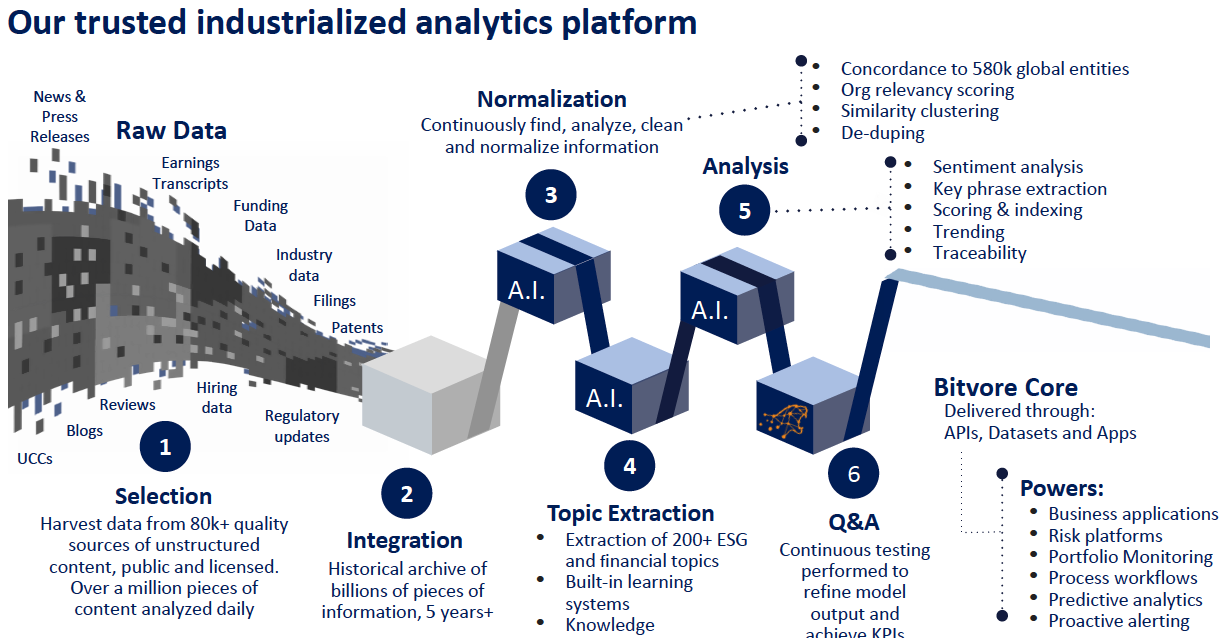

We take away the pain of sourcing, cleaning, normalization and correlating diverse data sets into one entity domain model.

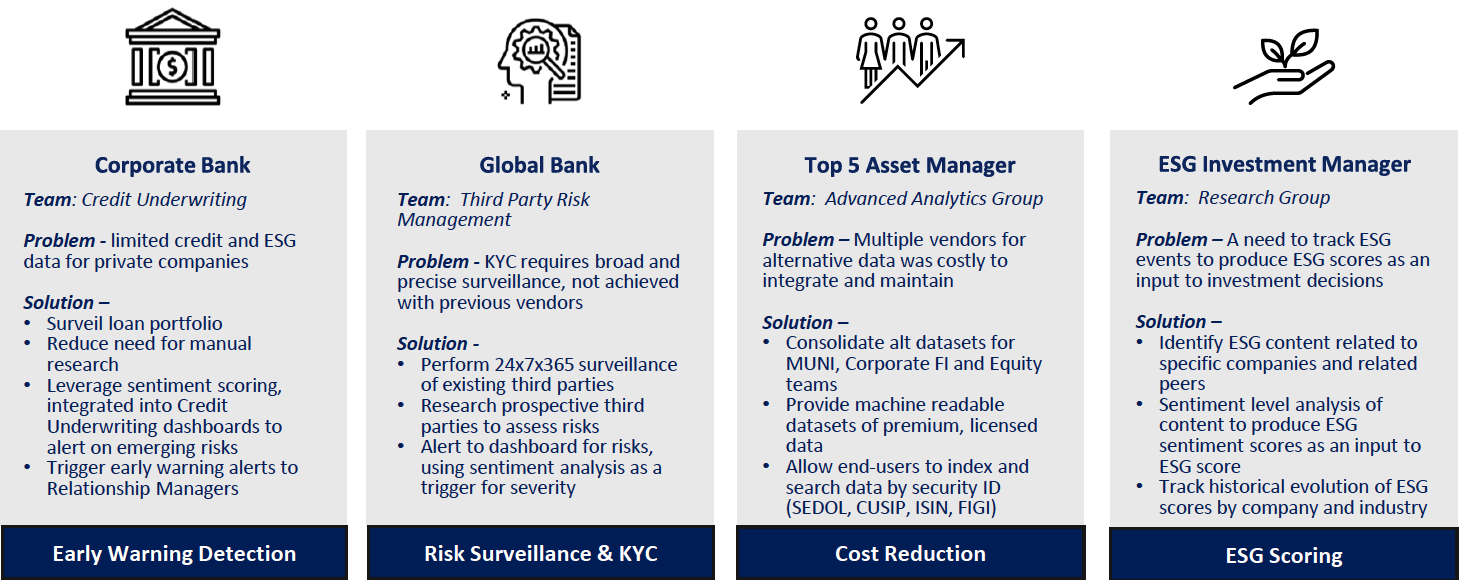

Trusted by more than 70 of the world’s top financial institutions, Bitvore provides the precision intelligence capabilities top firms need to offer transparency, counter risks and drive efficiencies with power of data-driven decision making and reporting.

Our clients uncover rich streams of risk and ESG insights from unstructured data that act as the perfect complement to internal data and insights firms are already generating.

Our artificial intelligence and machine learning powered system provides the ability to see further, respond faster, and capitalize more effectively.

Deriving sentiment scores from sentence-by-sentence analysis of a news articles and other content.

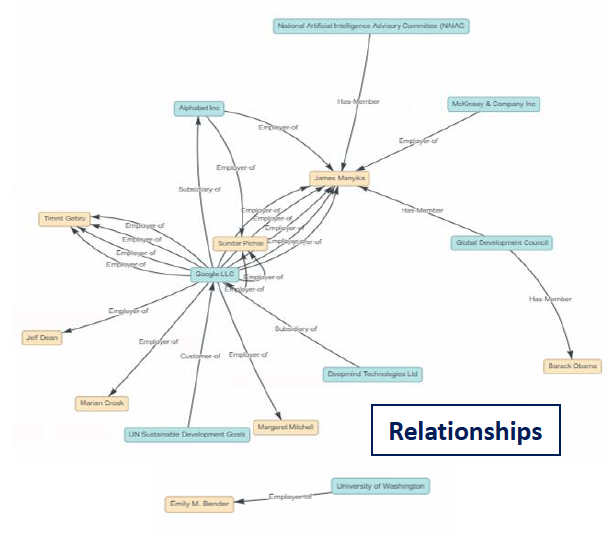

We don’t just look at entities in isolation, we access the entirety of their relationships and connections in context to flag opportunities and risks.

Clients can utilize “Layer 2” advanced tags for:

Detailed context, reference data and salience data with occurrences count and, as always, access to the underlying unstructured data source.

Four of the five largest US Banks and seven of the ten largest global investment managers are clients of Bitvore.

“Bitvore delivers a new level of transparency across the markets in just a few minutes a day” - Jim Nadler, President, Kroll Bond Rating Agency

“Everyone in our business needs this. It’s about the need for perpetual vigilance” - Charles Fish, CEO, Charles Fish Investments Inc

“We use Bitvore’s sentiment scores to monitor all our loan positions, saving us time and often a lot of money” - Head of Commercial Lending, New York Bank

“Bitvore’s solution saves me 3 hours a day, thank you!” - Bond Fund Manager based in Boston

“There’s no advantage having the same information as everyone else – Bitvore lets us see around the corners” - Andy Meyers, COO, Beckinridge Capital Advisors

“Our data scientists are utilizing Bitvore Plus to deepen our understanding, and risk analysis, of our clients’ and new prospects’ current relationships” - Commercial Banker based in New York

There are many

Copyright 2023 Bitvore Corp. All Rights Reserved. - Privacy Policy - Terms of Use