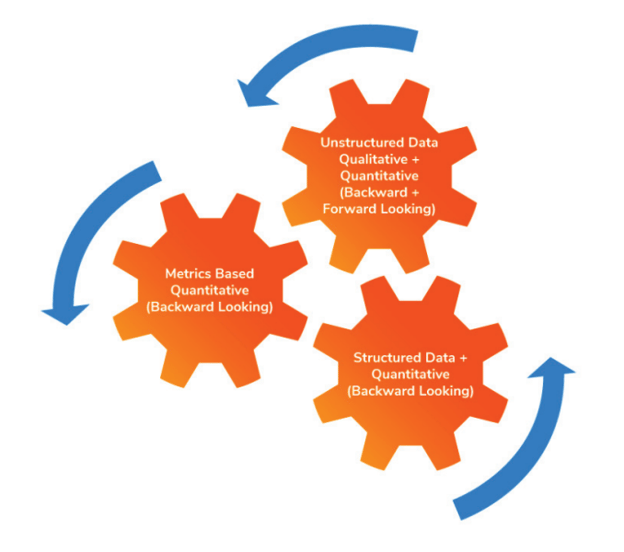

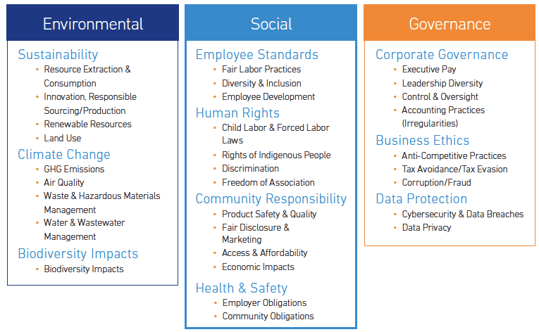

Bitvore’s proprietary Environmental, Social, and Governance (ESG) signals and sentiment scoring for 400K global public and private companies are derived from over 60K publicly available and premium unstructured data sources. These ESG signals and scores provide an “outward-in” view of a company’s performance against ESG standards leveraging news articles, press releases, transcripts and other unstructured data sources. While other ESG information providers focus on what companies say they do in their corporate documents and statements, Bitvore’s “outward-in” view focuses on what companies actually do based on material business events pertaining to ESG. Using machine-learned models (NLP), unique signals and sub-signals have been trained to allow users to quickly identify specific ESG topics of interest such as GHG emissions, Diversity & Inclusion, Product Safety & Quality, Cybersecurity and more.

Many ESG data providers focus on gathering and analyzing company published statements, Sustainability Reports and tracking ESG comments in transcripts. This can be helpful, but it is an inward-out view that represents only what a company says they do in terms of ESG.. To understand the outward-in view, it is necessary to identify specific ESG-related material business events that show what a company really does in terms of ESG, rather than just what they say they do. Bitvore identifies these ESG-related material business events (or signals) and the associated sentiment in a wide variety of quality unstructured data sources including:

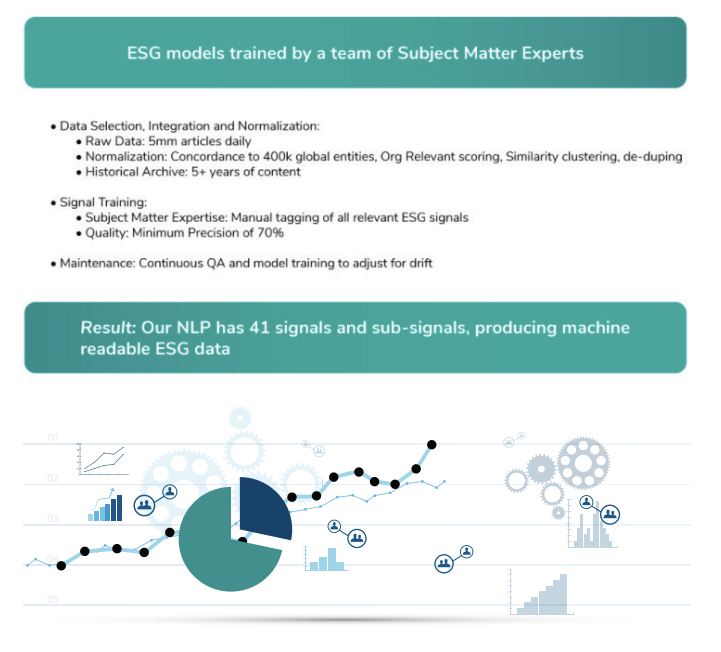

Bitvore’s NLP models are also trained by subject matter experts in ESG who understand the nuances between different ESG signals. Other companies use automated training supplemented with junior data annotators, which reduces precision quality metrics. In addition, our model training undergoes 5 or more cycles of training before we launch a new signal.

Some companies focus on deriving very specific scores, but given the lack of data for private companies, they limit their datasets to only cover public companies or large private companies. It’s preferable to include local news sources, regional sources, trade journals as well as the larger national / international news sources. For example, one major ESG data provider only covers public companies and has a fixed scoring process, whereas Bitvore tracks ESG signals and ESG sentiment for over 400k private and public companies.

Bitvore’s modular sentiment scoring allows customers to tailor specific ESG scoring calculations for unique portfolios. For example, if a client wants to calculate ESG scores for mid-sized private companies, they might choose to look at a 90-day rolling average of sentiment scores to assess a company’s ESG score. On the other hand, if a customer is tracking the S&P 500, they might find a weekly rolling average score or a daily score to be more appropriate for them. Most companies only offer one score, one solution. A one-size only solution may not fit all portfolios.

Download the below white paper for some key lessons learned by Bitvore and guidance on how to create and tune a Natural Language model to detect ESG events from unstructured data sets.

Bitvore’s comprehensive ESG methodology includes 24x7x365 surveillance and constant, daily updates.

Bitvore ESG datasets are an outward-in dataset to measure ACTUAL company and industry ESG performance using unstructured data. Key product features include:ß

Proprietary AI /Quality - Our NLP model has 41 signals and sub-signals, producing machine-readable ESG data. High precision models are trained with subject matter expert human annotators with continuous QA to adjust for drift.

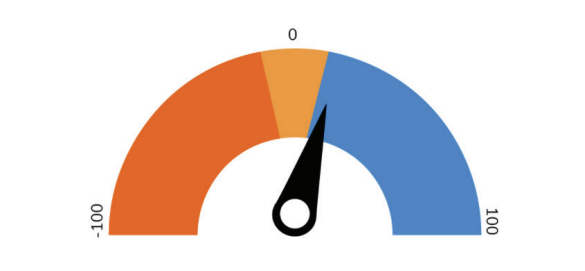

Quantifiable data - ESG sentiment analysis provided at the article level, with the ability to roll up to company, portfolio, industry and/or market level. ESG sentiment scores range from -100 to +100.

Virtual Real-time - 24x7x365 surveillance of ESG events impacting company and industry performances.

Aggregation of 60k unique sources of data – cleaned, normalized and ready for use. 12+ categories of content such as; News, Press Releases, Trade Journals, Transcripts, Filings and more. Up to 5 Million articles analyzed daily.

Easy Concordance - Normalization of content to entities and symbology reference database to concord entities across company names, tickers, SEDOL, FIGI, and CUSIP/ISIN (coming in Jan 2021).

Coverage - 5 Years historical dataset, covering a universe of 400k global public and private entities. Ex. Full coverage of the Russell 2000 and MSCI ACWI IMI and the MSCI ACWI World Indices.

Flexibility - Accessible through download files, API, or proprietary user interface. Ability to plug and play in Salesforce Einstein, Microsoft Power BI, Tableau and other data visualization tools.

Bitvore’s dataset consists of quality data from across 60,000 unique unstructured data sources, including both publicly available data as well as licensed subscription data. In addition to ESG signals, a sentiment score is also available at the article level, along with the relevant company metadata. Easy concordance of your portfolios to our companies, leveraging FactSet IDs, SEDOL and FIGI identifiers as well as CUSIP/ISIN, available for customers with these respective licenses.

Bitvore’s data is accessible via API, file download, as well as via our proprietary web interface.

Copyright 2023 Bitvore Corp. All Rights Reserved. - Privacy Policy - Terms of Use